Key insights

- Germany has a relatively high per capita income but low median wealth compared to other OECD economies.

- Three different factors can explain why Germans are less wealthy: housing, stocks, and private pensions.

- Germany is a nation of renters, which means that many have missed out from rapidly rising house prices.

- German workers prefer to hold on to cash and invest less in stocks.

- Germany’s company pensions are not based on participation in the stock market unlike in Anglo-Saxon economies.

Germany is a high-income economy…

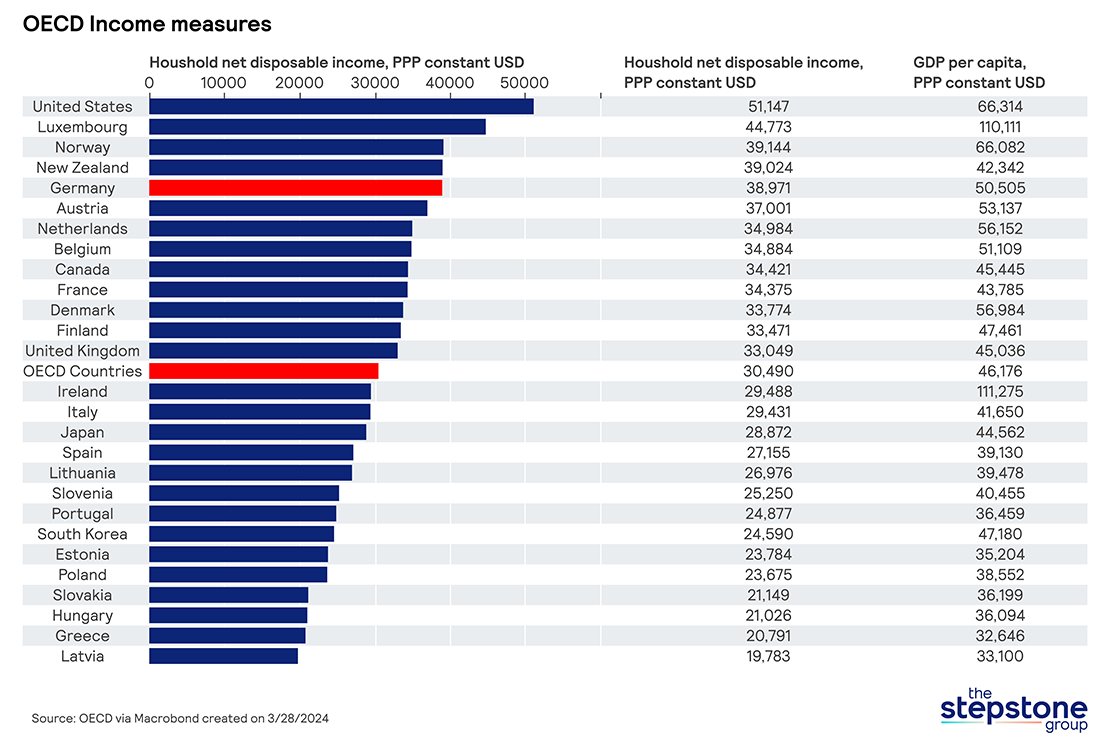

Despite its recent economic weakness, Germany remains one of the richest advanced economies in the world, according to OECD data.

While comparing incomes across countries is not as straightforward as it seems due to fluctuating exchange rates and differences in price levels, the OECD provides data that is purchasing power adjusted. This means that national price differences are taken into account.

Germany’s household net disposable income – the income that is left over after tax payments and social security contributions - is among the highest within the group of OECD countries.

By that measure, German households have 25% more purchasing power in real terms (adjusted for prices) than the OECD average!

…with low median household wealth

Wealth figures, on the other hand, are harder to come by. Some wealth is hidden in tax havens. The value of financial assets fluctuates. And because wealth taxes are rather uncommon, governments and tax collectors do not have a good overview of the financial assets that people own.

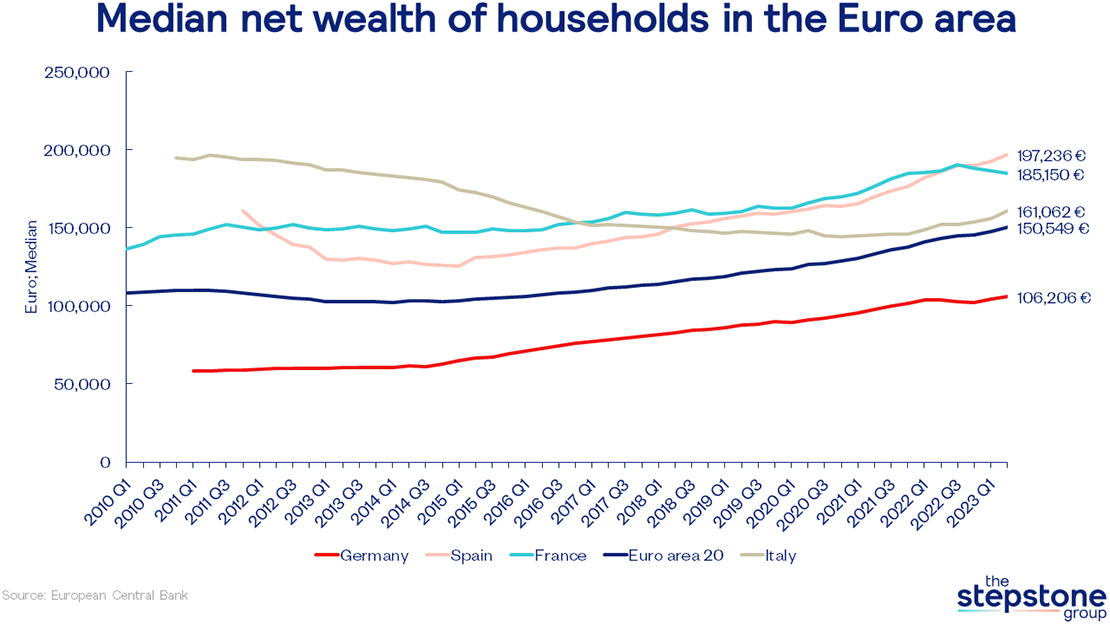

Nevertheless, we have some estimates for household wealth in the Euro area. They suggest that German households have significantly less financial wealth than households in France or the UK despite German incomes being higher.

While average wealth in Germany is comparable, median household wealth is significantly lower. The reason is that household wealth in Germany is more unequally distributed: The top of 10% households hold more than 60% of total wealth, a higher share than in most other European countries.

ECB data shows that the median household in Germany is significantly poorer than their French or Italian counterparts.

The UK stands out as having a particularly high median net wealth of just over £300.000 pounds (roughly €350,000).

There are three main reasons why Germany’s households are poorer.

Reason #1: Low homeownership rate

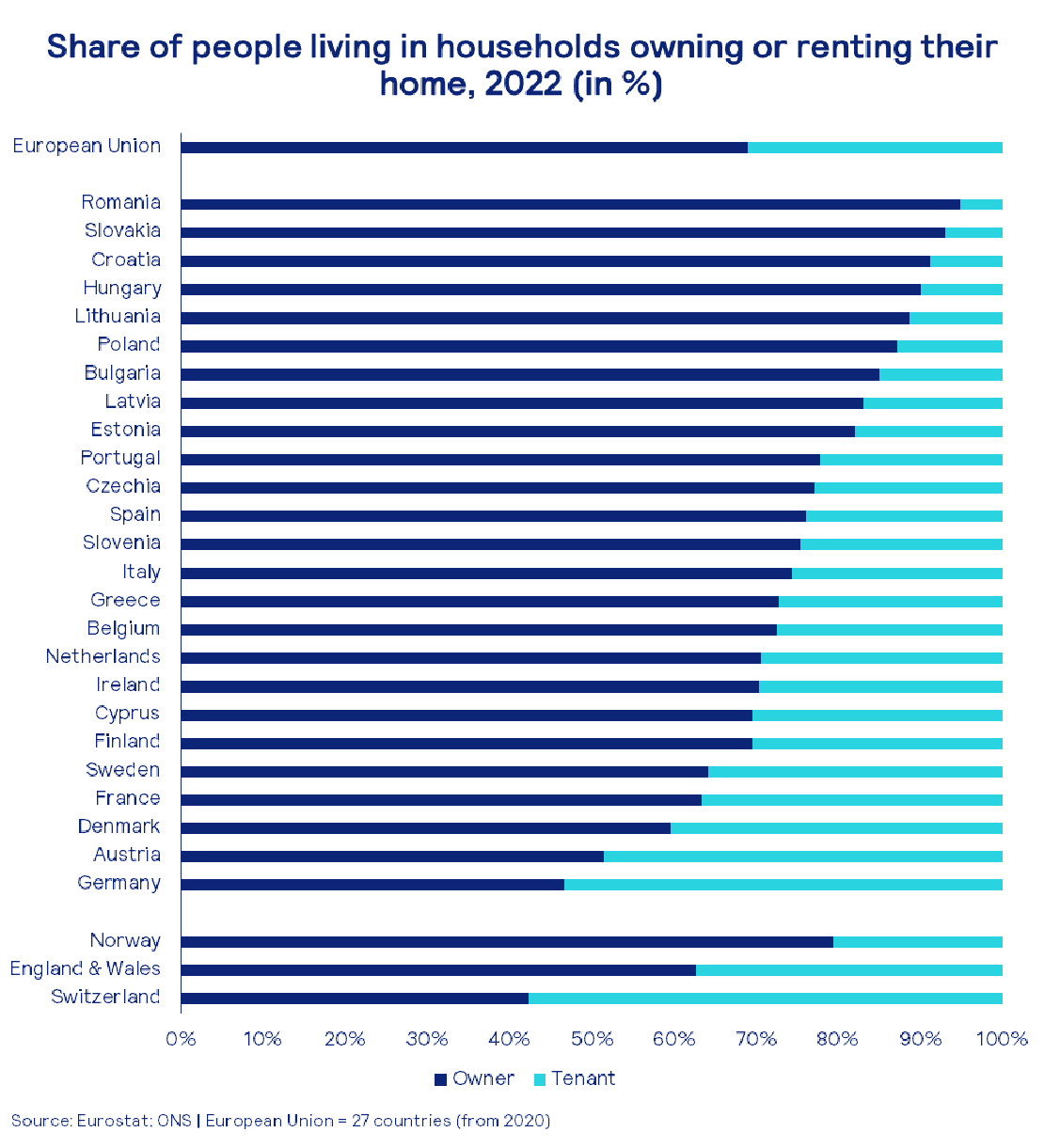

While Germany’s house prices had underperformed for a long time, the country has experienced a significant house price boom over the last decade. Even when taking the recent dip into account, house prices of existing homes have almost doubled since 2010.

However, many German households have not profited from the boom because the country has one of the lowest homeownership rates. Only about 40% of Germans are owning property while 60% are renters and therefore were unable to participate in the house price rally.

Reason #2: Low stock ownership rate

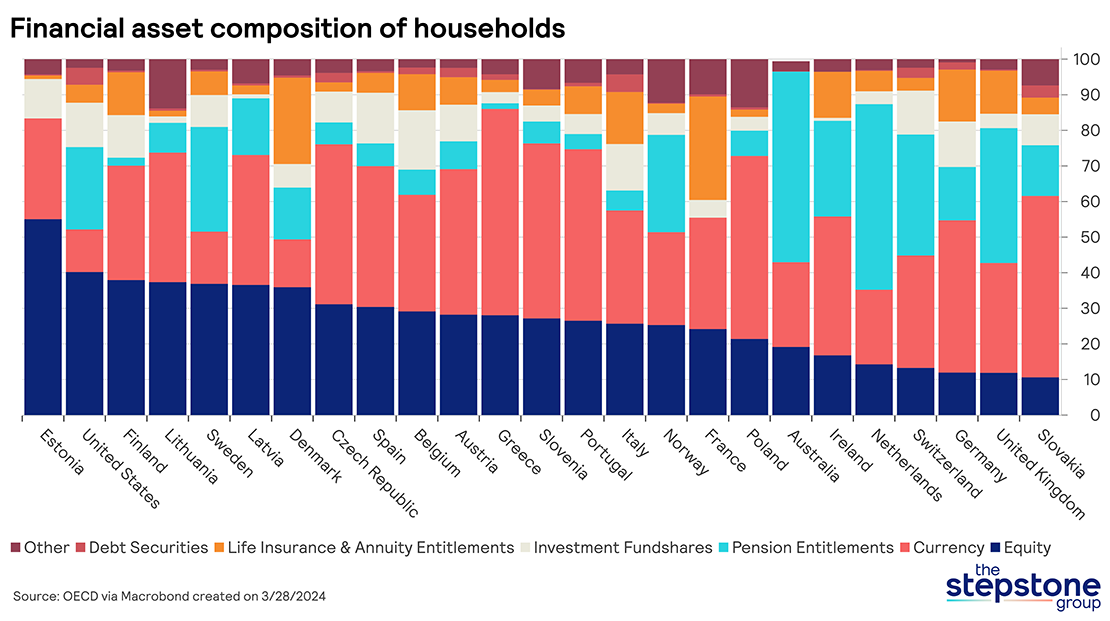

One might think that if Germans do not invest in real estate, they might put some of their money into equities. Alas, this also does not seem to be the case.

The OECD has data on the financial composition of household assets. While US households put close to 40% of their assets into stocks, German households allocate less than 10% of their portfolio to equities.

This is a severe mistake, given that stock returns adjusted for inflation (and not accounting for taxes) have averaged more than 7% per annum since 1950.

With German households having one of the largest cash allocations across rich countries, they are leaving a lot of money on the table.

Reason #3: Lack of private pensions

From the previous graph, one might have noticed that the UK’s equity allocation is relatively small, too. However, the pension system in the UK works very differently from the one in Germany.

The UK’s state pension only provides an annual income of around £11,500 whereas it is estimated that one currently needs more than £30,000 for a moderate and closer to £45,000 per year for a comfortable lifestyle in retirement.

Most employees in the UK therefore also have a defined contribution pension scheme (meaning that the total pension amount depends on how much you put in during your work life).

According to the ONS(Office for National Statistics), the median pension wealth of 55–64-year-old persons, so people close to retirement, was close to £260,000 whereas the 75th percentile stood at more than £500,000 in March 2020 (the most recent available data).

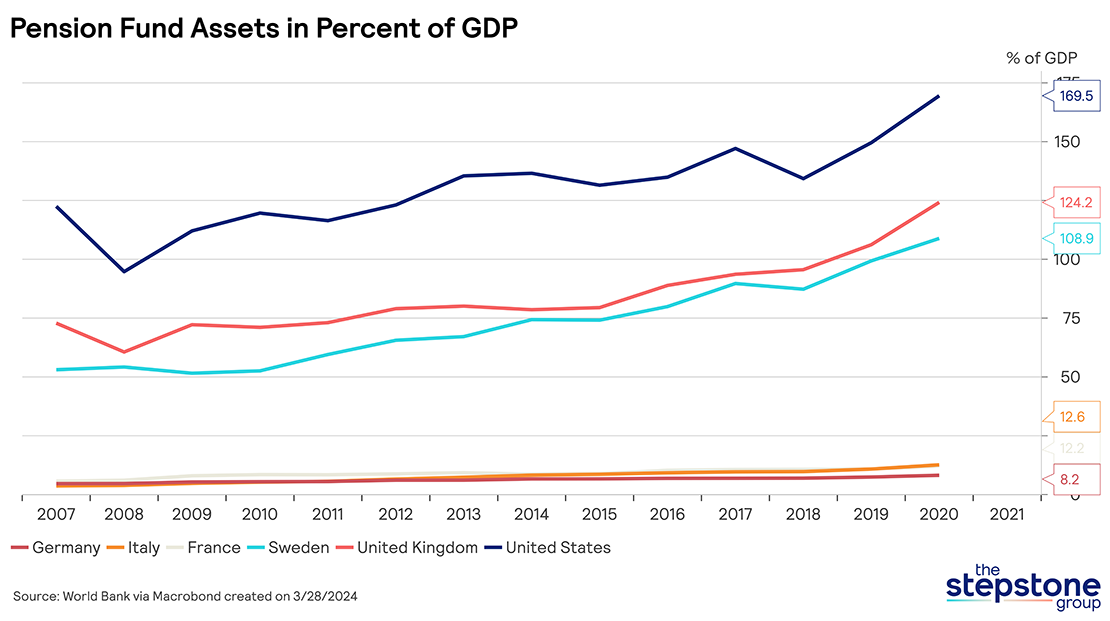

Total pension fund assets as a percent of GDP are close to 170% in the US, 125% in the UK, and exceed 100% of GDP in Sweden. In countries like France, Germany, and Italy, they are typically below 10% of GDP, given that private pensions are much less common.

While the UK equity allocation might be relatively low, UK households still hold a higher share of their net wealth in the stock market thanks to private sector pension schemes.

And total private pension wealth in the UK was closing in on 6.5 trillion pounds (about two times GDP) in March 2020.

What companies can do: Incentivize the creation of low-cost private-sector pension schemes

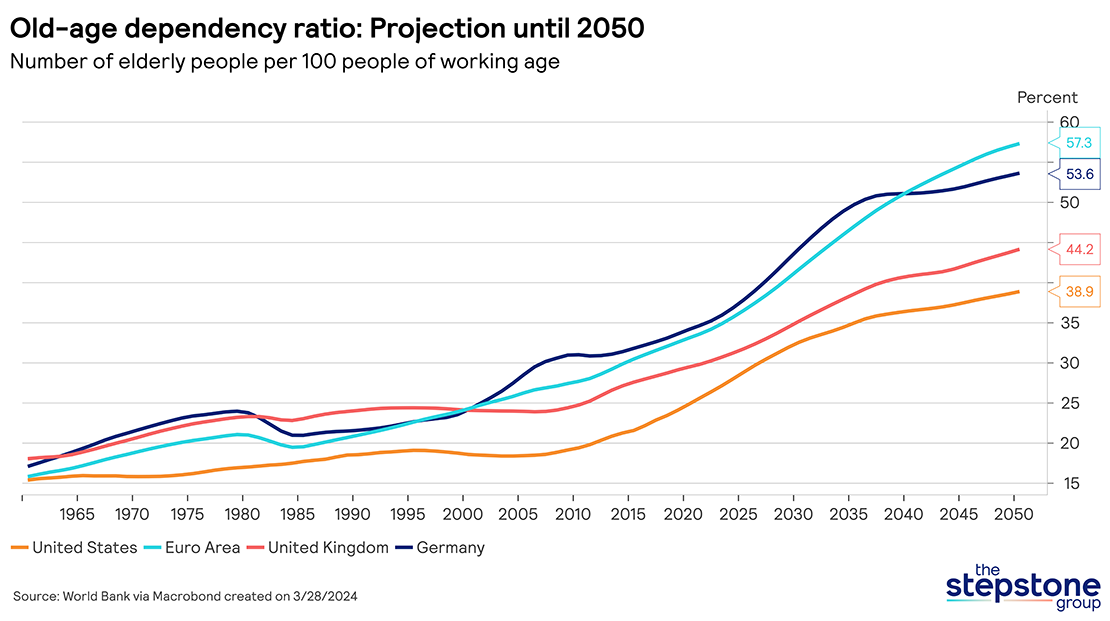

Germany’s public pension system is a pay-as-you-go system, meaning that contributions made by current workers are used to fund the pension benefits of current retirees. This structure is obviously extremely problematic, given that the German workforce is expected to shrink while the number of retirees is growing quickly. And life expectancy continues to rise. Even the planned reforms might be not enough to secure a stable pension system.

This means that workers now more than ever need to save privately for retirement. Germany’s private sector should, in a joint effort together with the government, aim to reform the country’s company pension system.

In Anglo-Saxon economies, most workplace pensions are based on defined contributions, meaning what you pay in determines how much you get out when you retire. The funds are managed by professional pension providers and are invested in long-term equities and other financial assets. While this is more risky, it also promises higher rewards.

In Germany, company pensions are usually paying out a fixed monthly income. The rules and regulations together with the tax incentives are anything but straightforward. Research shows that the average monthly payout after taxes barely was less than 650€ for men and less than 250€ for women in 2019.

In the UK, on the other hand, a retirement pot worth £500,000 would assure a monthly pre-tax income of more than £1760 for 30 years of retirement. Thanks to tax exemptions, the post-tax income on retirement pots of such size would still be significantly higher compared to many Germany company pension payouts.

Moving towards the Anglo-Saxon system where professional pension fund providers are managing your pension pot at a low-cost and where your own contributions are exempt from income tax could boost the retirement income of German employees substantially. Such an additional buffer will become increasingly important as the ratio of retirees to workers is steadily increasing across advanced economies.

Another way of boosting equity ownership would be for stock listed companies to allow all employees to participate in employee share ownership plans. These also are more common in the US than continental Europe, also because of tax reasons. Not only would share ownership plans allow workers to participate in long-run capital gains, but they also align employee and company interests more closely because the financial success is shared!

What the government can do: #1 Make housing more affordable

Boosting home ownership would be one way for German households to build up more equity than they currently do. Unfortunately, government policies aimed at increasing the home ownership rate are often misguided and end up being costly gifts for the middle-class.

Providing additional supply and making housing more abundant and therefore more affordable is the best policy to increase home ownership rates in the long-run.

#2: Create a tax-saving stock account

Any UK resident can put up to £20,000 each year into a so-called stock ISA (Individual Savings Account), which is completely exempt from income and capital gains tax.

Even if you manage to put only £5,000 aside each year for 30 years, your total portfolio value would amount to more than £330,000 for a total contribution of only £150,000, assuming a relatively meagre annual 5% rate of return. The total capital gain of more than £180,000 would then be tax free.

In Germany, on the other hand, you would have to pay 25% capital gains tax. Additionally, there is the Soli surcharge (a tax intended to fund the reunification of Germany), plus church tax, if applicable. When all is said and done, taxes on capital gains in Germany can amount to 28.63%, a loss of £52,000 compared to the return on a UK ISA portfolio of the same size.

To boost household wealth, the German government should create a similar tax-free stock investment vehicle. This would incentivize more Germans to participate in capital markets and increase equity ownership over time.

Conclusion

Despite being a very high-income country, German households are poorer than their European counterparts because of how their wealth is allocated. Given the recent inflationary surge, a proper allocation to high-performing assets like equities, real estate, and pensions might now be more important than ever.